The Panama Papers have recently drawn a great deal of investigation and public attention.Over 230,000 organizations and individuals were named as having set up offshore companies in tax haven like the British Virgin Islands, Panama, the Cayman Islands or the Bahamas. The public’s initial reaction was suspicion and anger toward any person or company named in the papers.

However, just being listed in this document, or setting up a business in a tax haven does not mean anything illegal or secretive was done. The line between the legal and illegal establishment of offshore companies can be blurry, but it doesn’t mean it’s always wrong.

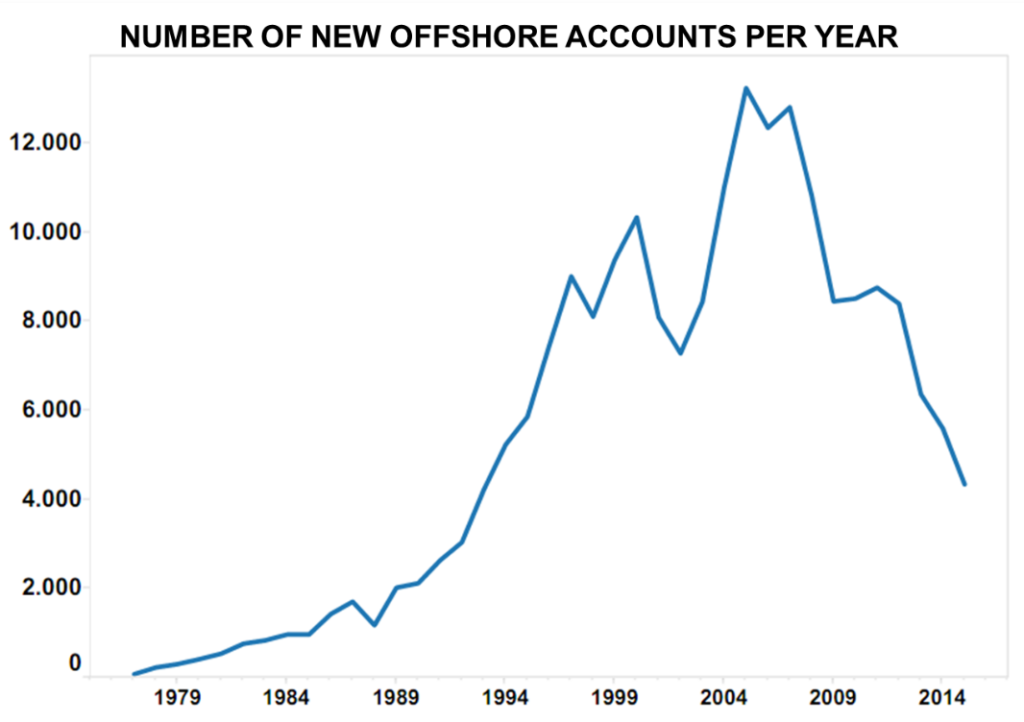

The practice of establishing multinational companies in tax havens has become more and more common since 1970. The peak for new offshore accounts was reached from 2004 to 2007, as shown below.

The number of new offshore accounts has plunged recently. This is due to the introduction of more stringent laws and regulations regarding capital transfers and international investments by local companies and citizens. This means offshore accounts that are already set up have even more advantages than before because it’s become too cumbersome to set up an entirely new structure.

Multinational corporations and wealthy families normally use offshore companies to minimize their taxes and maintain their privacy. Many tax havens have a low or almost zero tax rate on investments and business operations. Tax havens also often have little or no requirements on financial disclosure so there is a high level of privacy.

The establishment of offshore companies is legal. Companies and families are entitled to choose where they want to set up their business operations. However, it is illegal to use these offshore accounts to engage in money laundering, tax evasion, price transfer or other illicit activities.

How do multinational companies use tax havens?

Multinational companies can establish subsidiaries or branches in other countries to conduct business. These branches will then transfer any profits (or losses) back to their parent company. Then the profit will be taxed by the government of either the host country or home country.

To minimize taxes, a multinational company may establish one more subsidiary in a tax haven. Those subsidiaries usually do not have any specific manufacturing or trading business. They are just used to legally avoid taxes owing to other countries.

In particular, a parent company will transfer the ownership of intellectual property, such as patents or copyrights, to its subsidiaries in tax havens. This intellectual property could be used to collect revenue from operating branches in other countries through copyright using contracts.

High copyright fees will eat into profits from those operating branches, thereby minimize their corporate taxes duties to their countries. Then, all profits accrued to the offshore subsidiary would be taxed at a zero percent rate at the tax heaven. By not repatriating those accumulated profit back to their home country, those companies started building pile of cash on offshore accounts. This is the reason why Apple AAPL -0.06%, Microsoft MSFT +0.79% and Coca-Cola have been able to save hundreds of billions of dollars during previous years. Whether these structures are legal will depend on whether the contracts between the subsidiaries can be attributed to pricing transfer for tax evasion from the host countries. As to those sectors mentioned above, it is fairly difficult to determine the existence of pricing transfer due to the complication of the valuation of fair value of the contracts for intellectual properties.

Multinational companies may also incorporate using more complex structures with money flowing through several countries. By doing this, profits from international operations will be retained in the tax haven without transferring to the parent company.

So, the issue is not whether these tax structures are illegal. The legality depends on why the structures were set up in the first place.

How do wealthy families use tax havens?

It is entirely legal for wealthy families to transfer assets out of their home countries if they can prove the legality and origin of the assets. Families are able to open accounts in tax havens to reduce taxable income from investment operations. However, this activity is considered illegal if it is primarily done for tax evasion or money laundering by secretly transferring money out of their home countries through unofficial channels.

There is another figure released in April in Vietnam worth public attention. It is the Balance of Payment (BoP), which shows economic transactions between residents of a country and the rest of the world over a specific period of time. There is always a significant amount of errors and omissions in the BoP. These errors and omissions reflect the transactions that the government cannot record. This means there is a “latent” amount of money leaving countries like Vietnam that the government has no record of.

Peter Pham is a contributor for Forbes and writes this piece.